PayPal boasts a user base of 295 million people worldwide. In just the first half of 2019, it processed nearly six billion transactions. It’s widely known because it’s a consumer-friendly platform. Now, what if you want to become a small business owner — should you stick with PayPal because it’s a leader? Or should you venture over to its rival Stripe instead?

Stripe vs. PayPal: Choosing The Best For Your Business

Before you decide to sign up for PayPal – or switch over to Stripe – let’s review some of the differences between the two.

Transaction Fees

While the transaction fee (2.9% + 0.30 cents per transaction) is the same for the two platforms, PayPal does go more in-depth with its cost breakdown. For instance, you can view the fees for:

U.S. and international transactionsMicropayments and large paymentsProfit or non-profit paymentsTransactions processed through a virtual terminal

You can also assess the fees for:

Recurring billingCurrency conversionsRefundsChargebacksAmex paymentsMobile card reader transactionsand so on

Based on this, some will say PayPal wins because of transparency. Yet, others will agree Stripe keeps its fee structure simplified, which means no unexpected costs.

Types of Payments Accepted

If you’re doing business online, you need a platform that accepts as many forms of payments as possible. For PayPal, this includes:

PayPal (of course)Credit cardsDebit cardsPayPal CreditPay by phone

However, not all payment types are available to everyone. For instance, Pay by Phone transactions are only available if you have the Payments Pro plan. Stripe, on the other hand, accepts payment types such as credit and debit cards, Apple Pay, Google Pay, and many more.

Countries and Currencies Accepted

Now, if you’re a business that’s planning to go global, then you need the proper support. Let’s see which offers the best. First up is Paypal, which accepts payments from over 200 countries. Stripe on the other hand only accepts 25 countries. However, PayPal only processes transactions in 25 currencies, compared to Stripe’s 135+. We can call this one a tie, depending on how you look at it (and what matters more to your business).

Advanced Billing Options

How are you planning to process payments from your customers? You’ll find both come with exceptional advanced billing options, such as:

InvoicingMarketplace solutions (Stripe Connect)Subscriptions

Since Stripe is more focused on e-commerce, there’s no option for mobile chip readers or integration with POS systems.

Integrations with Other Tools

Both Stripe and PayPal come with integrations with various e-commerce and finance tools. However, Stripe takes the cake, since it has a lot more options available. Here’s a look at some of the things you can integrate the platform with:

Customer Relationship Management (CRM)Customer supportEmail marketingFundraisingInventory managementRecurring paymentsForm buildingReferral marketingAnd more

So How Do You Set Up Stripe?

What’s great about online payment tools is that you can test them out for free. So if you’re excited to give Stripe a test run, then you can be up and running in no time.

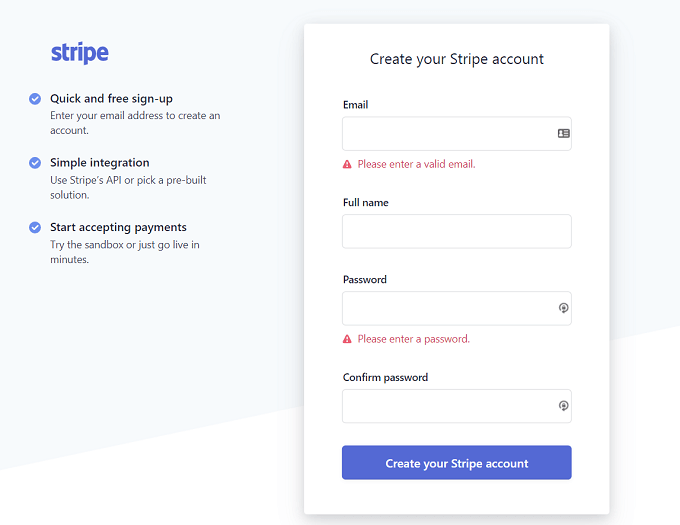

Sign up with your email address, full name, and a strong password (at least one cap, number, and non-alphanumeric character).

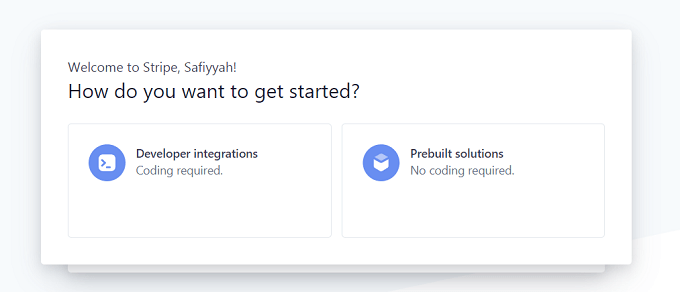

Confirm your account email address (check your inbox).Since you’re likely not a developer, select the Prebuilt Solutions option.

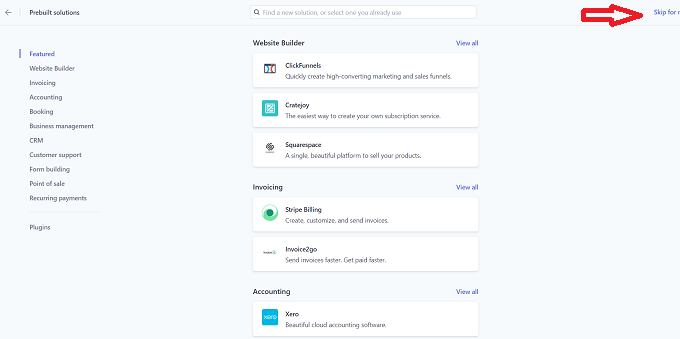

On this page, you’ll be able to integrate the platforms you’re using, such as Squarespace or Xero. Otherwise, click Skip for now.

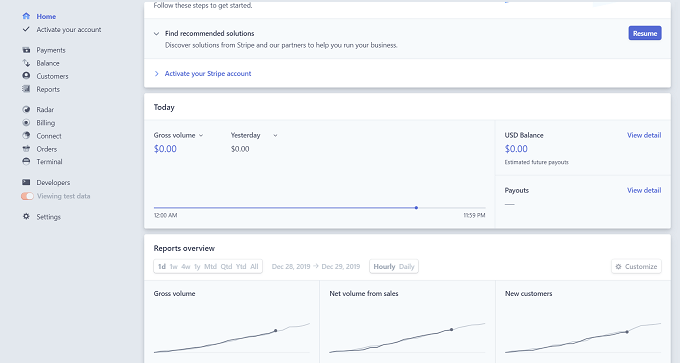

Now you’re in your dashboard, where you can see all of your transactions by the day, week, month, quarter, or year.

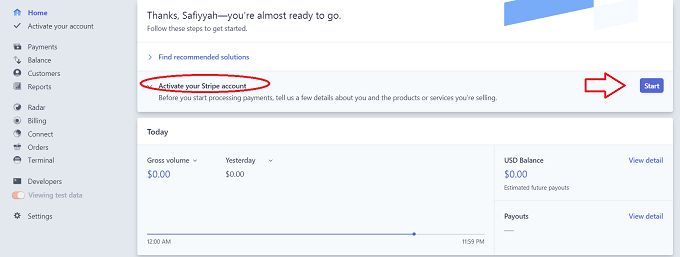

To begin accepting Stripe payments, you’ll need to set up your bank account. Funds don’t sit in your account like with PayPal. However, you will have to wait seven or so days, depending on the type of business you have. The riskier your business, the longer the waiting period. At the top of your dashboard, you’ll see Activate your Stripe account. Click this to drop down the menu and select Start.

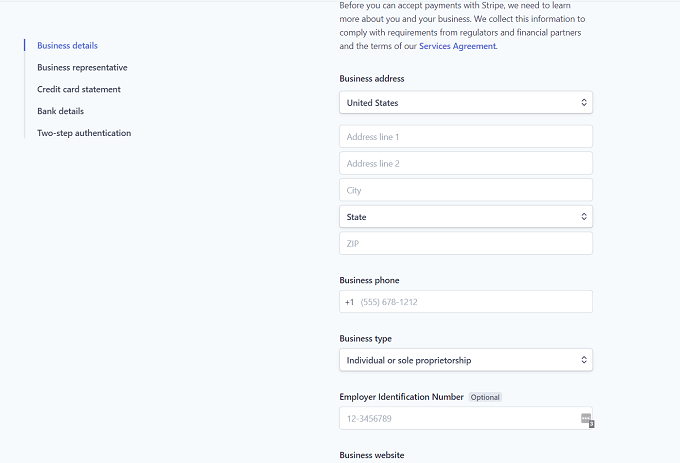

Next, you’ll need to insert all of your business details. At the end, insert your bank details and set up two-step authentication (recommended for security).

Using Your Stripe Account

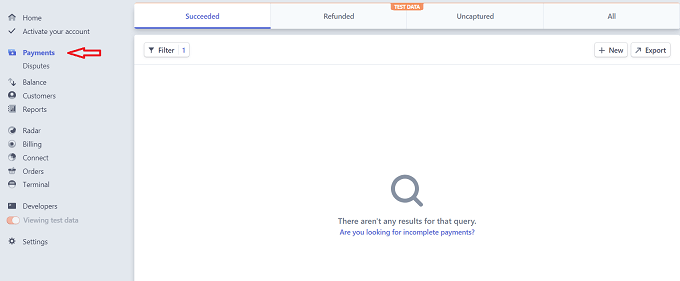

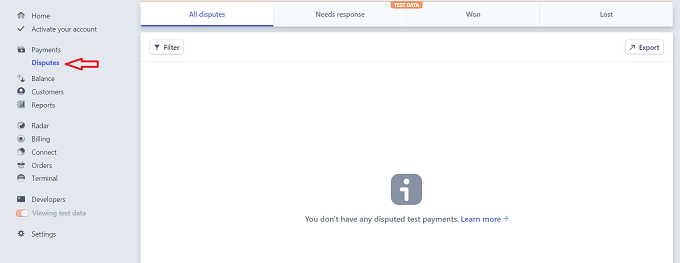

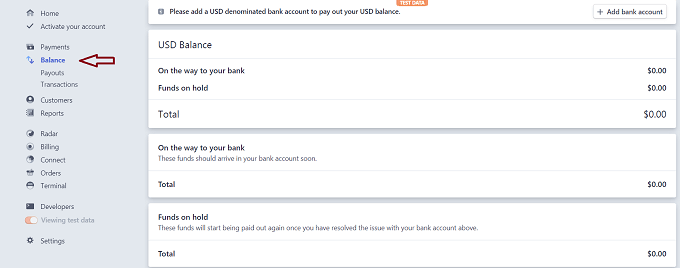

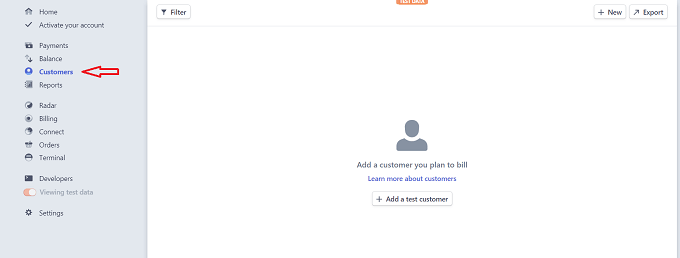

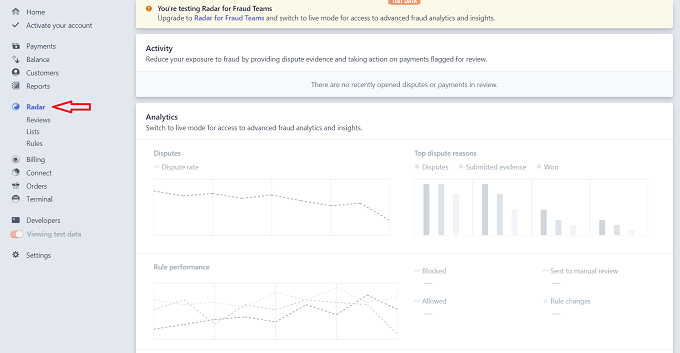

Once you’re all set up, you can check out all of the great features Stripe has to offer. For instance, you can look at your Payments and categorize your view based on those that succeeded, were refunded, or are uncaptured. You can also look at your disputes you have open that need your response. Plus, you can filter them based on those you won or lost. Under the Balance section, you can see how much money is on the way to your bank, and how much is on hold. The funds on hold will require resolving the issue with your bank account. Under the Balance section, you’ll find Payouts and Transactions. Your payouts are the funds sent to your bank account. The transactions show all – those sent and pending. In your Customers section, you can add clients so you can easily bill them when the time arrives. The Reports section is another handy tool, which will allow you to see an overview of your transactions over the course of months or the past year. Radar is another analytics feature you can use to see your account overview. This will tell you how many disputes you received (lost and won). Then under the Billing tab, you’ll be able to see more analytics regarding your business. For instance, you can see a snapshot of your:

Growth in revenue and subscribersRetention and churn ratesAverage revenue per subscriberOutstanding invoices

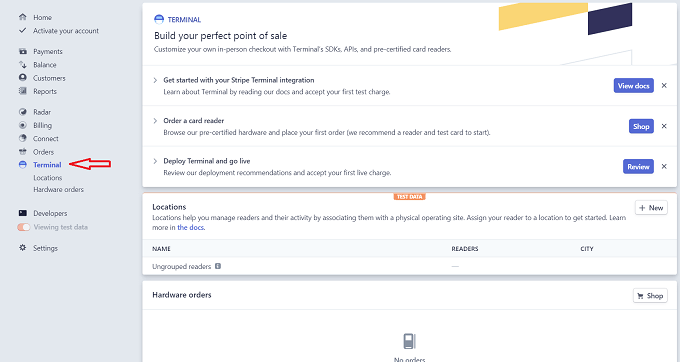

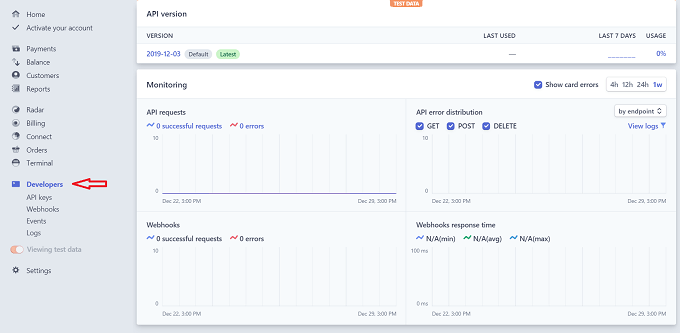

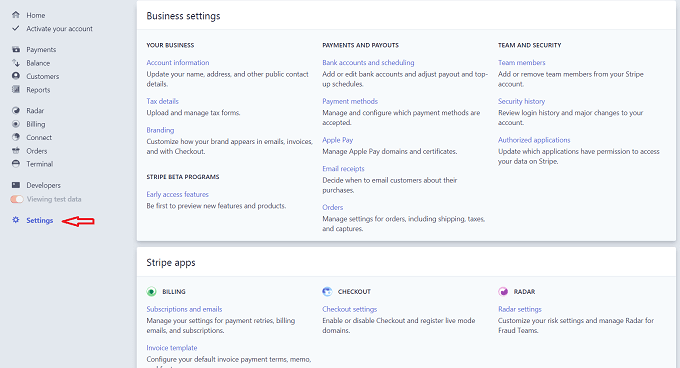

Beneath Billing on the menu, you can look at your products, tax rates, coupons, subscriptions, and invoices. If you want to see your orders placed, you can click Orders in the menu. Plus, you can review your products. When you’re ready to get to the technical side of things, you can play around with the Terminal section, which is where you’ll integrate a terminal for POS. The Developers section will allow you access to the API, where you can do further integrations. In your Settings, you can change your business details, add Stripe apps, and review compliance and reporting documents.

Strive Vs Paypal: Stripe Is a Simple & Safe Bet!

Stripe is a growing rival for Paypal and for good reason — it offers more. It has something for the coders, as well as the business owners who want to more integrations for their payment setup. It’s simple and quick to get started with Stripe, so why not set your account up and see how it compares with PayPal?